DRIPs, or Dividend Reinvestment Programs, are typically aimed at smaller retail investors. As such, they are not often on the front radar screen of most Investor Relations departments. Still, as shareholders, DRIP investors end up being fairly loyal, and in most cases do not sell shares based on news, market movements, or other “events.” So, in a very real way, DRIP investors act much like a stock buyback in that they remove shares from the market for longer periods of time. A large DRIP program could theoretically have a nice positive impact upon a company’s long-term stock price.

DRIP Investors

Most stockholders in DRIP programs are very small time investors. Often, they are inspired to setup such an investment after reading a magazine article or website which touts their benefits. Therein, lies the difficulty. Typically, such investors will have little or no experience with investing other than mutual funds and their retirement accounts. Thus, their knowledge base regarding how stocks, the stock market, and public companies work will be very limited. So limited, in fact, that just figuring out that “Investor Relations” means them may be a challenge, and the concept of a transfer agent will most likely be completely foreign. A one liner directing potential DRIP investors to the main page of a company’s transfer agent will likely result in failure for converting an interested investor into an actual investor.

A more effective means of converting these small time prospective investors into actual company shareholders can be accomplished with just a small amount of effort. Such effort, can virtually be a one-time thing that continues to pay dividends (pun intended) well into the future.

Investor Relations and DRIPs

Since the DRIP programs at most companies are administered by a third-party, many firms simply to choose to take a hands off approach to investors seeking information about a companies DRIP program by directing them, whether directly or indirectly, to the third-party that handles the DRIP. However, those companies generally offer DRIPs for several publicly traded companies. They have neither the time nor inclination to provide any sort of company specific information to prospective investors.

Additionally, many IR departments and their companies are concerned that offering too much information may be construed as an offer to sell securities which, of course, opens up a whole basket of potential problems.

So, for a lot of companies, the only information on their direct stock purchase program is an answer in the FAQ that says, “Yes, we offer a plan, click here.” While completely sufficient, and for the savvy investor, more than adequate, this can be confusing to a novice shareholder, especially when the link in question points to the transfer agent’s home page where such an investor will get lost in a sea of what must be just mumbo jumbo to them.

However, a proactive IR department looking to acquire and retain more investors of any size can have a huge affect on this dilemma with just a single webpage or two of educational content.

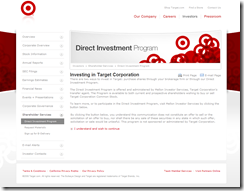

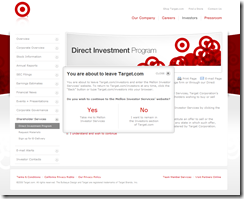

For example, take a look at these images taken from Target’s investor relations site. Instead of burying the information in the FAQ or elsewhere for the user to find, they have an actual webpage complete with normal header for the direct investment program. There is very little text on the page, but what their is satisfies even the new investor’s questions. It points out that an investor can use the program or a brokerage account. Then, the page notes that the direct investment program is administered by its transfer agent, and says that to learn more the user will need to click the “button” below. (It’s actually a link, so that is a tiny bit confusing, but we’ll chalk that up to design issues.)

The link sits directly beneath the disclaimer that the program is not an offer to sell securities, meeting requirements for both proximity and likelihood that the investor knows what they are agreeing to.

The link sits directly beneath the disclaimer that the program is not an offer to sell securities, meeting requirements for both proximity and likelihood that the investor knows what they are agreeing to.

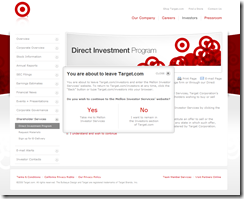

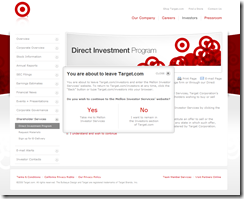

In this case, Target has also chosen an additional notice that the investor is leaving the Target site. When the user clicks yes, the landing page is customized to users coming from the Target site. This prevents confusion among investors who might otherwise wonder if they are “in the right place,” and whether or not they have stumbled upon something too complicated to continue with.

The landing page at BNY Mellon spells out exactly why the users are here, and what their options are for the program. Finally, the link for the Target specific information and details sits at the bottom of the page.

The combination of these two tiny pages accomplishes multiple things for the IR department. First, it fulfils any obligation to notify users of the program as well as providing the necessary link to the appropriate third party. But, while the FAQ answer stops here, these pages also ensure that the user understands where they are and why. They confirm that the link they have followed it the “right” one regardless of whether they are an existing shareholder or a new shareholder, and finally, they ensure that the potential investor will arrive at the program details without any doubts or concerns. In total, these benefits add up to less calls and emails to the IR department who otherwise might be involved by investors looking to “make sure” that they are doing it right, and also lowers the number of calls received by the transfer agent from prospective investors looking for a live person to confirm that things are in order.

As is often the case, a little extra communication ensures a smoother process for both future shareholder, and IR department.

Brian is a small business owner, consultant and freelance writer. Brian began his professional career in the computer industry as a consultant where he became keenly aware of the internal workings of companies from Fortune 100 giants to small two-man shops. While working with a mutual fund company, Brian developed a strong interest in finance and became a Certified Financial Planner. As a financial professional, Brian specialized in working with small business owners. Brian is the co-founder of ArcticLlama, LLC a premier business writing and consulting firm. He also runs a real world personal finance blog. Brian lives in Denver with his wife and daughter.