The TechnoratiMedia 2013 Digital Influence Report has been released, and according to the results, brands have taken their digital messaging to the social web. However, there is a lot of room for improvement.

The TechnoratiMedia 2013 Digital Influence Report has been released, and according to the results, brands have taken their digital messaging to the social web. However, there is a lot of room for improvement.

Nine out of 10 brands surveyed for the study indicated that they have a presence on Facebook, and nearly 7 out of 10 brands reported that they participate in online influencer marketing. Across the board, digital ad budgets are increasing with mobile being a key focus for brands in 2013.

Taking a closer look at the data from the study, you can see where brands are spending time on social messaging. The following data shows the percentage of brands with presences on some of the most popular social sites:

- Facebook = 91% of brands

- Twitter = 85% of brands

- YouTube = 73% of brands

- Pinterest = 41% of brands

- LinkedIn = 33% of brands

- Blogs = 32% of brands

- Instagram = 29% of brands

- Google+ = 26% of brands

The data gets more interesting when you look at where brands are spending digital budgets. Nearly 75% of brand digital budgets are being spent on display advertising, search, and producing video. Only 10% is spent on social, and that includes influencer outreach. Breaking the social spending down further, more than half goes to Facebook while YouTube and Twitter each get 13%. Only 6% is spent on influencer outreach, and just 5% is spent on blog advertising.

Considering that consumers surveyed in this study cited blogs as the third most likely online service to influence their purchase decisions (behind brand sites and retail sites but above Facebook, YouTube, and all other social sites), it’s evident that brands are missing a significant opportunity to connect with consumers when they’re making purchase decisions.

When asked where brands planned to increase spending in 2013, 59% plan to increase social advertising and video spending while fewer brands plan to increase search, display advertising, and programmatic buys (37%, 31%, and 21%, respectively). The big winner in terms of higher budget in 2013 will be mobile, which 79% of brands plan to increase.

However, there is more to the data than the percentage of brands that plan to increase budgets in specific channels and areas. While most brands plan to increase mobile ad spending, the actual dollar amount increase for mobile is expected to be just 37% versus 73% for display and 52% for search. Like mobile, social spending will also increase by just 37% when you look at actual dollars being spent. Video spending will increase by 30% and programmatic buys will increase by only 17%.

So while the world is becoming more and more mobile and people are spending more time on social sites and blogs than ever, traditional display advertising is still the primary focus for brand marketers. What do you think? Missed opportunities?

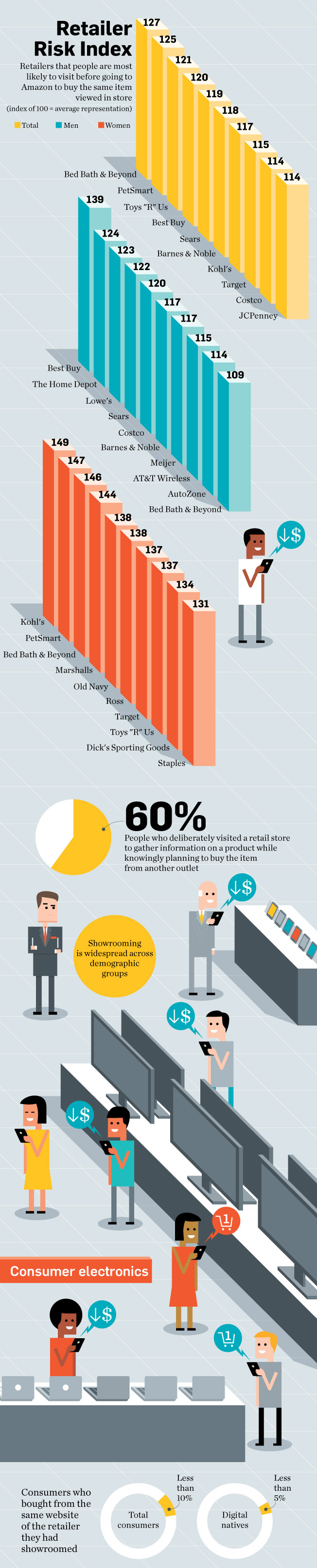

In recent years, the term “showrooming” has taken on a negative meaning for brick-and-mortar retailers as more and more consumers visit physical stores to research products but then go online to purchase those products at a lower price.

In recent years, the term “showrooming” has taken on a negative meaning for brick-and-mortar retailers as more and more consumers visit physical stores to research products but then go online to purchase those products at a lower price.

Most brand marketers still invest more of their marketing budgets in traditional marketing activities than they do on social media marketing activities. Even digital marketing budgets are skewed more heavily towards traditional online marketing activities than they are towards social media marketing activities. According to

Most brand marketers still invest more of their marketing budgets in traditional marketing activities than they do on social media marketing activities. Even digital marketing budgets are skewed more heavily towards traditional online marketing activities than they are towards social media marketing activities. According to  The market segments that existed 20 years ago have changed significantly with the spread of wireless devices, instant communication, instant access to information, and instant gratification. The parameters used to define college students, teens, and twenty-something market segments have seen some of the biggest changes, and those changes have led to significant misperceptions about the people in those segments.

The market segments that existed 20 years ago have changed significantly with the spread of wireless devices, instant communication, instant access to information, and instant gratification. The parameters used to define college students, teens, and twenty-something market segments have seen some of the biggest changes, and those changes have led to significant misperceptions about the people in those segments. A new study by the Interactive Advertising Bureau (IAB) and Nielsen provides strong evidence that shifting television advertising dollars to online advertising drives positive results.

A new study by the Interactive Advertising Bureau (IAB) and Nielsen provides strong evidence that shifting television advertising dollars to online advertising drives positive results. We often hear about the most influential brands in the United States, the United Kingdom, and the EU5, but what are the most influential brands in Canada? According to a survey of internet users by

We often hear about the most influential brands in the United States, the United Kingdom, and the EU5, but what are the most influential brands in Canada? According to a survey of internet users by