When I teach or give a public talk, I like to bring in a variety of sources in order to keep the audience engaged (and also to prove the worth of my liberal arts education earned many years ago). I find that introducing something interesting, which, at first blush has no connection to the topic, helps to get people thinking about what you’re saying. Of course, sometimes it’s the only thing they remember from your talk, but I’m happy if they remember anything.

When I teach or give a public talk, I like to bring in a variety of sources in order to keep the audience engaged (and also to prove the worth of my liberal arts education earned many years ago). I find that introducing something interesting, which, at first blush has no connection to the topic, helps to get people thinking about what you’re saying. Of course, sometimes it’s the only thing they remember from your talk, but I’m happy if they remember anything.

For example, a number of years ago I was given the task of explaining executive benefits at a 7:00 AM meeting. Talk about deathly dull topics at a time of day when most people are struggling to wake up. The strategy I hit upon to liven things up enough to keep people awake was to use song lyrics to illustrate my points. I had to work at it – not many songs mention stock options or long term disability insurance – and eventually references ranged from Gershwin to 1960s Motown to Pink Floyd, but I kept the audience interested in what I was saying.

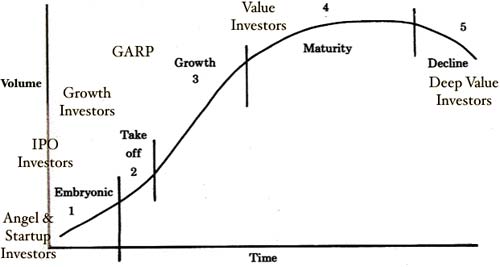

I bring this up because one of the obscure references I like to mention when I discuss the role of communications in investor relations is Sisyphus. Those of you that were blessed with a proper grounding in Greek mythology will recall that Sisyphus was the Greek King who incurred the displeasure of Zeus and was sentenced to roll a huge boulder up a steep hill, only to have the boulder roll back down to the bottom of the hill before he arrived at the summit, forcing Sisyphus to begin all over again. This ceaseless effort very concisely describes the process of communications in investor relations.

When you are communicating with investors, as they used to say in an old Nike ad, “There is no finish line”. The company is constantly moving towards its next reporting date. You are either just reporting results or getting ready to report results. The company and its strategy are continually evolving, requiring you to refresh your message. The composition of your investor base is also routinely changing as the stock is bought and sold, causing you to have to regularly educate an entirely new set of investors. In short, it never stops.

Nor should it. Good investor relations requires continual communication with investors and potential investors. The more you communicate in a transparent manner, the fewer surprises will confront investors and the less volatile your stock will be. When more information that is routinely transmitted to the Street it also means that there is less opportunity for insider trading. In short, as in economics, more is generally better until you arrive at the point of disutility. What constitutes disutility of information is a discussion for another day. For now, I will leave you to roll the rock up the hill.